What History Can Teach Us about Real Estate Property Prices During and After a Crisis

There are lots to learn from history. While the current COVID-19 situation is different from previous crises, there are lessons that can be taken from the past.

Lessons from the SARS Outbreak in 2013

Although the SARS outbreak in 2013 did pose some challenges, the global and Canadian economies did not suffer as much damage compared to the fallouts from the current novel coronavirus outbreak. There was no significant slowdown in the Canadian economy. In fact, Canadian GDP experienced a growth from $758 billion in 2002 to $892 billion in 2003. This upward trend in GDP growth continued, as it surpassed the trillion threshold in 2004.

Similarly, property market sales in Toronto did not suffer from SARS outbreak in 2003. Sales increased from 74,759 units in 2002 to 78,898 units in 2003. The growth in sales and prices was in line with long-term trends. What might have differentiated the ‘untouched’ economic conditions in Canada back then was that most of the cases of SARS were concentrated in its epicentre in Hong Kong. COVID-19 has claimed more lives than SARS did in 2003, and there is a lot more uncertainty this time around.

Evidence from the Toronto real estate market in 2003 suggests that Canada did not experience a noticeable adverse impact from SARS. Although the economic impact of COVID-19 in 2020 is grimmer, many predict that the effect of the current pandemic on the Toronto real estate market will likely be moderate in the short run. Other factors at play – historically low interest rates, strong housing market fundamentals, governmental stimulus programs to help individuals and businesses impacted by business and employment disruption, and the fact that Toronto continues to be a world-class city for education and job opportunities – will help the housing market weather the hits experienced by other asset markets such as financial stocks.

An analysis that looked at the change in house prices shows that there was no decline in house prices during SARS. For most of the second half of 2002, GTA home prices increased by 10-15% range. Home sales in the GTA in February 2020 were growing by over 40% compared to last year, and prices were growing by just under 20%. Even if half of GTA home buyers step out of the market, there would still be a competitive seller’s market with approximately 2.5 months of inventory. This means that instead of a home getting 7-15 offers, it might get 2-4 offers.

Lessons from Past Decades

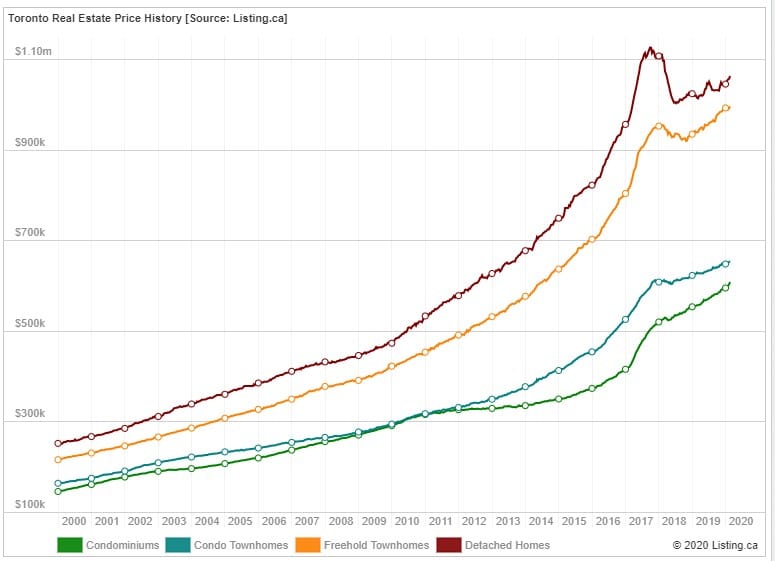

Historically, the Canada’s housing market doesn’t have a history of severe depreciations, even in tough times. Over several decades, Canadian home prices have appreciated more than 5% per year. Just like how you should not try to time the market when buying and selling stocks, buyers should not try to time the housing market.

Recession may be looming as a result of business slowdowns and closures amidst the COVID-19 pandemic, but housing markets tend to adjust during recessions or economic downturns. This is because the number of homes listed of sale might decrease, and the number of buyers might decrease as well, so supply and demand remains largely in balance. Craig Hennigar, the Director of Market Intelligence at Colliers International, said, “If you look back over the last 20 or 25 years, there have been very few periods where we actually had a drop in prices for more than 12 months in most markets.” If the GTA real estate market is to take a hit, it would be short term.