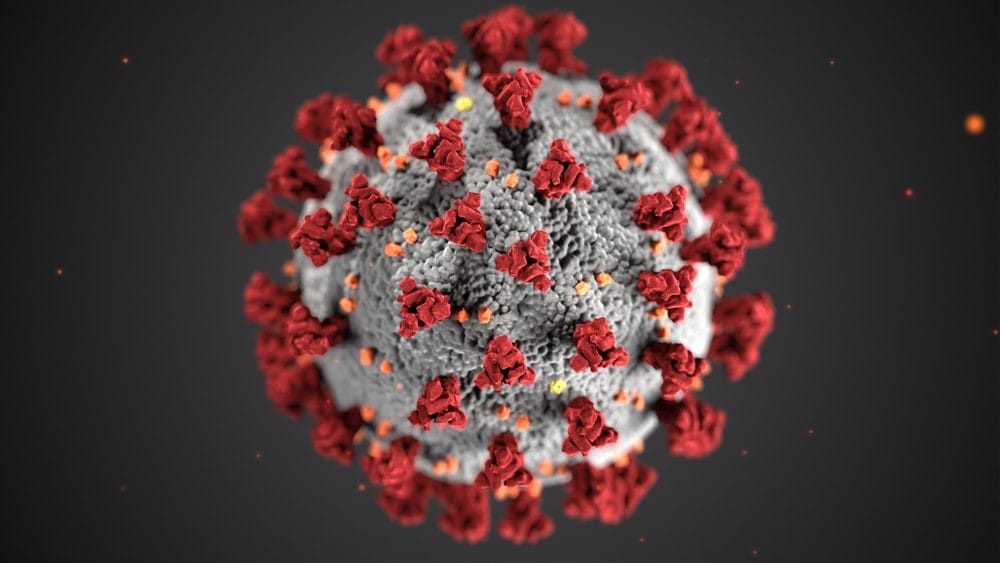

COVID-19 (Coronavirus)’s Impact on Toronto Real Estate

By now, you likely have heard of World Health Organization (WHO)’s official declaration of a COVID-19 (coronavirus) pandemic. As of March 11, 2020, there are more than 118,000 cases of COVID-19 in 114 countries, with 4,291 deaths globally. Outside of China, the number of cases has increased 13-fold in the first 2 weeks of March 2020, and the number of affected countries has tripled. What does this mean for the real estate market in the GTA?

Minimal Impact on the GTA Real Estate Market

Compared to other major cities in North America, the number of confirmed cases of the novel coronavirus (COVID-19) in Toronto is relatively low. As of March 12, 2020, there are 19 confirmed positive cases of the virus, while other “presumed cases” are still being investigated. This brings the provincial total to 42. The virus outbreak has not yet put a major dent in the GTA real estate market. There is, however, some impact with international buyers. With travel bans and people cancelling flights and travel plans, international visitors with the intention of coming to Toronto to buy property may be putting their plans on hold.

Stock markets around the world have been hit hard, with Dow Jones index plunging into bear market in just 20 days. The residential and commercial real estate sector, however, moves more slowly. Leasing fundamentals generally do not swing wildly from day to day. In other words, the real estate market is less susceptible to global event shocks compared to the equity market.

Lower Interest Rates and Savings for Home Buyers

In response to COVID-19 and in an attempt to stimulate the economy, the Bank of Canada cut interest rate by 50 basis points to 1.25% on March 4, 2020. This is following the U.S. Fed’s decision to cut interest rate from 1.75% to 1.25%. What does this mean for home buyers? Lower mortgage rates. Because banks and lenders typically change their prime rates based on the Bank of Canada’s key interest rate, this will translate to lower mortgage rates. Lower interest rates usually correspond to more buying, because people can borrow money for cheaper and have more means to buy.

Potentially Higher Home Prices

With lower interest rates, buyers can increase the amounts they can borrow. More buying means potentially lower supply, driving home prices up. This could be a boon for both buyers and sellers (buyers can afford larger or more expensive homes with lower mortgage rates, while sellers can sell for higher prices).

If you’re selling (or planning to sell) your home, check out the article on home showing tips during the coronavirus outbreak.

Impact on Existing Mortgage Borrowers

If you currently have a fixed rate mortgage, depending on what the current prime rate is at the time of mortgage renewal, you might be able to renew with a lower rate. Speak to your Mortgage Advisor about mortgage renewal. If you have a variable rate mortgage, the amount of interest paid is tied to the overnight lending rate. Savings from lower prime rates are usually passed on to consumers almost immediately.

Looking Ahead

Despite the COVID-19 outbreak, the GTA real estate market remains strong. We can look back in history to see how the SARS outbreak in 2003 played out. Although the market did slow down a bit, and the ‘closing the deal’ process took longer, there was still a healthy pulse of activities in real estate buying and selling. Experts are forecasting a slightly quieter spring, but more robust summer and fall 2020.

Recent testing by scientists in China has indicated that the coronavirus is “highly sensitive to high temperatures”. Although summer weather won’t necessarily eradicate the virus completely, there is speculation that warmer weather will slow down the spread of the virus. Flu season in Canada traditionally ends in May. The Ontario government has also announced a $100-million contingency fund to deal with the global pandemic in this province.

As a buyer, you can take advantage of the lower interest rates by shopping for a mortgage and home before prices skyrocket. As a seller, you might be able to benefit from the potentially higher home prices come summer and fall.